Cost Recovery Implementation Statement 2023-2024

Updated 30 November 2023

Australian Industrial Chemicals Introduction Scheme (AICIS)

Web: www.industrialchemicals.gov.au

Email: Use our 'Contact us' webform

Phone: 1800 638 528

Phone: +61 2 8577 8800

1. Introduction

Cost recovery involves government entities charging individuals or non-government organisations some or all of the efficient costs of undertaking specific government activities. This may include the delivery of goods, services or regulation, or a combination of them. The Australian Government Charging Framework (Charging Framework), sets out how government entities design, implement and review regulatory charging activities, consistent with the Public Governance, Performance and Accountability Act 2013.

Purpose of the Cost Recovery Implementation Statement

This Cost Recovery Implementation Statement (CRIS) provides information on how the Australian Industrial Chemicals Introduction Scheme (AICIS) will implement cost recovery for its regulatory activities in 2023-24. The purpose of this document is to transparently demonstrate how regulatory charging has been developed to comply with the Charging Framework and to clearly outline the regulatory charges to be applied from 1 September 2023. The CRIS also reports financial and non-financial performance information for these charging activities and contains financial forecasts for Financial Years (FY) 2023-24 through to 2026-27.

Description of regulatory charging activity

The Industrial Chemicals Act 2019 establishes AICIS as the regulatory scheme for the importation and manufacture (introduction) of industrial chemicals in Australia. The scheme is administered by the Executive Director supported by staff within the Australian Government Department of Health and Aged Care. The Department of Climate Change, Energy, Environment and Water (DCCEEW) undertakes the environmental component of AICIS assessments and evaluations under a service level agreement with AICIS.

The main purpose of AICIS is to aid in the protection of human health and the environment by assessing the introduction and use of industrial chemicals and providing information and recommendations about managing any identified risks. AICIS is designed to make regulatory effort proportionate to the risks posed by industrial chemical introductions and to promote innovation and encourage the introduction of lower-risk chemicals.

The information from AICIS assessments and evaluations is made available to state and territory and other Commonwealth agencies to assist in regulating the use, release and disposal of industrial chemicals and to support the wide range of chemicals management legislation for the protection of human health and the environment.

Key AICIS regulatory activities are summarised below and described in more detail in Section 3:

- Scientific assessment and evaluations of industrial chemicals

- Compliance monitoring and enforcement of statutory obligations on industrial chemical introducers under the Industrial Chemicals Act 2019

- Maintenance of the Australian Inventory of Industrial Chemicals (the Inventory)

- Strategy, planning and organisational support activities

- Implementing Australia’s obligations under international agreements (relevant to industrial chemicals).

The full cost of administering the scheme is recovered from the regulated industry through fees for services and registration charges (levies). Fees for services apply to regulatory activities attributable to a service provided to a specific introducer. The registration charge relates to the regulation of the market as a whole and funds regulatory activities that are not attributable to a service provided to a specific introducer.

AICIS fees for services apply to activities such as pre-market assessments and authorisations of unlisted chemicals, listing chemicals on the Inventory or amending Inventory listings, applications to protect confidential business information and authorisations to import/export industrial chemicals subject to international agreements. All registrants pay an annual application fee to be listed (or re-listed) on the Register of Industrial Chemical Introducers.

Most of AICIS’s operational costs are met from the annual registration charge levied on importers and manufacturers (introducers) of relevant industrial chemicals. Where an introducer imports and/or manufactures relevant industrial chemicals above a certain threshold, an annual registration charge is payable. The applicable levy depends on the introduction value of relevant industrial chemicals introduced in the previous financial year and is calculated based on a statutory formula1.

Activities supported by the annual registration charge include: evaluation of chemicals (including those listed on the Inventory), post-market compliance monitoring and enforcement, provision of information and recommendations about managing risks from the introduction and use of industrial chemicals, collection and publication of information and statistics, and corporate activities to support the efficient operation of the scheme.

Appropriateness of cost recovery and who pays

It is Government policy that the full cost of AICIS regulatory activities be recovered from regulated entities (introducers of industrial chemicals). Refer to Section 2 for details on the policy authority that supports AICIS charging arrangements and Section 3 on the design of those charges.

Consistent with the Government’s policy position, full cost recovery is considered appropriate because:

- introducers create the need for the regulatory activity to be undertaken by Government by placing industrial chemicals in the market;

- to effectively regulate the introduction of industrial chemicals under the Industrial Chemicals Act 2019, Government requires skilled staff and sufficient technical resources to undertake a number of essential activities; and

- charging provides transparency about the cost of resources involved in regulating the introduction of industrial chemicals. It also promotes equity by ensuring that those who use or create the need for Australian Government regulatory services continue to bear the costs.

1 Industrial Chemicals Charges (Customs; Excise; General) Regulations 2020, subsection 6(1). [Establishes the method to work out the value of relevant industrial chemicals introduced in a financial year]

2. Policy and statutory authority to cost recover the regulatory activity

Government policy authority to recover the cost of regulatory activity

The policy authority to fully recover the cost of activities of industrial chemical regulation was provided for in the 1994 95 Budget under the measure “Implementing full cost recovery in 1996–97 for National Industrial Chemicals Notification and Assessment Scheme”.

On 26 May 2015, the Australian Government announced its decision to implement a range of reforms to the regulation of industrial chemicals2. These reforms were implemented through the establishment of AICIS, which replaced the National Industrial Chemicals Notification and Assessment Scheme (NICNAS) on 1 July 2020.

The establishment of AICIS did not change the Government’s policy position that the full cost of regulatory activities be recovered through fees and charges paid by regulated entities (introducers of industrial chemicals). Full cost recovery continues to be applied and is considered appropriate because introducers continue to create the need for industrial chemicals in the marketplace to be regulated.

Refer to Section 3 for further details.

Statutory authority to charge

Fees for services are specified in Ministerial rules made under the:

Charges are specified in regulations made under the:

- Industrial Chemicals Charges (Customs) Act 2019

- Industrial Chemicals Charges (Excise) Act 2019

- Industrial Chemicals Charges (General) Act 2019

The three charges Acts provide the statutory basis for the registration charge to be based on annual introduction value. As AICIS regulates both the importation and manufacture of industrial chemicals, the registration charge could be legally characterised not only as a tax but also as a duty of customs or a duty of excise requiring three separate acts.

2 MEDIA RELEASE Tuesday, 26 May 2015 – Industrial chemical assessments simplified <https://parlinfo.aph.gov.au/parlInfo/download/media/pressrel/3856085/upload_binary/3856085.pdf;fileType=application%2Fpdf#search=%22media/pressrel/3856085%22>

3. Cost recovery model

Overview of the regulatory activities

Scientific assessment and evaluation of industrial chemicals

AICIS undertakes pre- and post-market risk assessments/evaluations to identify potential risks to human health and/or the environment that may be associated with the import, manufacture, formulation, use, storage and disposal of industrial chemical(s) in Australia. AICIS makes recommendations to relevant risk management agencies, where required, to ensure appropriate controls are in place for the protection of human health and/or the environment from their introduction and use.

AICIS issues certificates and commercial evaluation authorisations for the introduction of unlisted industrial chemicals into Australia following a pre-market assessment. AICIS also monitors reported and exempted chemical introductions and maintains the Australian Inventory of Industrial Chemicals (The Inventory).

Assessment/evaluation statements are published on the AICIS website for use by all stakeholders, including other Australian Government and state and territory regulatory agencies such as public health, worker health and safety, environmental, transport and consumer product safety agencies.

AICIS implements a science strategy to maintain high quality scientific risk assessments though delivery of various technical outputs such as technical training and guidelines, gathering chemical intelligence, and collaborating with other chemical regulatory authorities to inform assessment and evaluation activities.

AICIS also assists Australia to meet its obligations under international agreements regarding industrial chemicals and works with other countries to harmonise and adopt (where applicable in the Australian context) international standards and risk assessments methods

Compliance monitoring and enforcement

AICIS undertakes activities such as compliance monitoring of introducers of industrial chemicals under the Industrial Chemicals Act 2019, compliance audits, managing compliance cases, liaising with other Australian enforcement agencies and administering Australia's obligations relating to industrial chemicals under the Rotterdam and Minamata Conventions.

Fit for purpose regulation

The Industrial Chemicals Categorisation Guidelines and the Industrial Chemicals (Fees and Charges) Rules, are regularly reviewed and updated to ensure AICIS regulation remains contemporary and fit for purpose. AICIS also provides stakeholder education and guidance on the industrial chemicals legislative framework to assist Industry understand their regulatory obligations.

Strategy, planning and corporate activities

Corporate activities support the efficient and effective administration of the Scheme. These include: managing the Industrial Chemicals Special Account and cost recovery arrangements, registration of introducers and maintenance of the Register of Industrial Chemical Introducers, strategic communication and website management, stakeholder engagement, and ensuring the Scheme’s compliance with regulatory and business reporting requirements.

Regulatory outputs and design of regulatory charges

The cost base for AICIS comprises several activities which, when taken together, are necessary to efficiently and effectively regulate the introduction of industrial chemicals under the Industrial Chemicals Act 2019. These activities can be aggregated and grouped into two broad categories: regulatory outputs and support activities.

Regulatory outputs are activities provided to an individual or organisation or those provided to a broader group of individuals and organisations. In 2023-24, AICIS will continue to recover the costs of undertaking regulatory activities using a combination of fees and charges (levies) based on the demand for a government activity or intervention.

AICIS charges fees for services where a direct relationship exists between the regulatory activity and the individual or organisation requesting that specific activity. All regulated entities are charged the same fee for the same activity. Under these circumstances, the activities performed, and their associated costs are driven by a specific need and demand created by the applicant (an application).

Each fee for service item can be broken down into a number of business processes. For all applications, the business processes are:

- screen application

- assess application

- decide application

- notify applicant

When the cost of the AICIS activity can be reasonably attributed to a broader group of organisations (or individuals) rather than a single entity, the activity will continue to be funded through a cost recovery levy. In these instances, the level of demand for Government activity or intervention is collectively driven by the industry as a whole rather than a single entity within it. Table 1 outlines regulatory outputs and support activities classified as direct costs and support activities that are classified as indirect costs.

Table 1 – Examples of AICIS outputs as direct and indirect costs

| Regulatory outputs: Direct costs (fees for services) | Regulatory outputs: Direct costs (cost recovery levies) | Support activities: Indirect costs |

|---|---|---|

| Registration of introducers | Compliance monitoring and enforcement | Management of Special Account |

| Certificate applications | Post-market evaluation of chemicals | Human resources management |

| Authorisation applications | Pre-introduction reports and post-introduction declarations | Corporate governance |

| Inventory listing applications | Maintenance of Inventory | Facilities and building |

| Confidential business information (CBI) protection applications | Stakeholder engagement/education | Website and IT |

| Applications for import / export of industrial chemicals into or out of Australia | Enquiries and complaints management | Regulatory and business reporting |

Costs of the regulatory charging activity

The key cost drivers in estimating the cost base for AICIS are:

- the effort for each business activity,

- the resources needed to conduct each business activity, and

- the annual volume of each business activity performed.

When AICIS was established in 2020-21, regulatory charging was based on historical effort data (resources required and frequency or annual volume data) from comparable NICNAS activities (where available). These activities were used as a proxy to estimate the effort and corresponding cost of undertaking similar AICIS activities. Where comparable NICNAS activities were not identified, management estimates were used for effort and corresponding costs. It has since been identified that fundamental differences between the schemes limits the utility of historical data as a wholly reliable proxy of true effort and associated costs for all regulatory activities. Estimates of volumes were affected by impacts of the COVID-19 pandemic on global supply chains and domestic markets.

To refine effort and cost estimates, historical data have been used to establish a resource baseline that is adjusted as actual scheme data become available. This has allowed AICIS to better understand the efficient resourcing requirements for administering the scheme (see ‘Ongoing commitment to appropriate charging arrangements’ below).

Additionally, an in-depth time capture exercise has been undertaken to validate effort estimates used to date and identify potential changes to future charging arrangements; initially conducted over 11 weeks between October and December 2021. Due to a lack of volumes across specific activities, a supplementary time capture exercise commenced in September 2022 and is ongoing.

Collected data indicates more effort was spent on some fee for service activities than historically estimated. As AICIS application volumes are yet to normalise and the effort observed across similar activities has been variable, AICIS considers that it would not be appropriate to adjust fees for services at this stage. To further refine the accuracy and robustness of effort estimates in the Activity-Based Costing model, the time capture exercise will continue. Any proposed changes will be the subject of consultation with industry stakeholders in the context of development of the 2024-25 CRIS.

The cost of the environmental component of risk assessments undertaken by DCCEEW are included within the AICIS cost base. Table 2 details the estimated cost base for the 2023-24 financial year and forward estimates for the following three years.

Table 2 - AICIS estimated cost base, 2023-24 to 2026-27 ($’000)

| Expenses | 2023-24 | 2024-25 | 2025-26 | 2026-27 |

|---|---|---|---|---|

| Employee and contractor expenditure | 13,360 | 13,757 | 14,166 | 14,587 |

| Non-employee expenses | ||||

| Supplier (including DCCEEW) | 7,148 | 7,302 | 7,410 | 7,521 |

| Depreciation3 | 1,120 | 1,120 | 1,120 | 1,120 |

| Allocation to operating reserve4 | - | - | - | - |

| Total5 | 21,628 | 22,179 | 22,696 | 23,227 |

The cost base in its entirety comprises the estimated costs of efficiently and effectively delivering regulatory functions. Costs such as those incurred for policy functions by other areas within the Department of Health and Aged Care, other than AICIS, are specifically excluded from the cost base, as these are funded by Government.

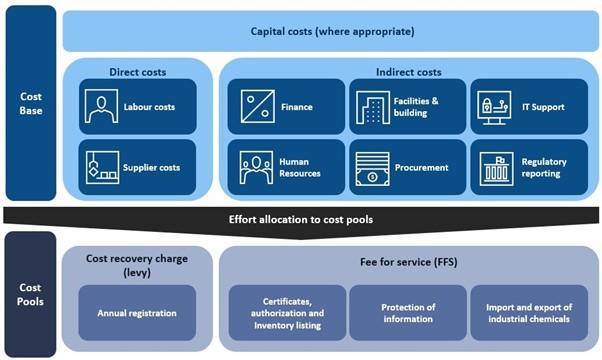

AICIS uses an activity based costing (ABC) methodology to allocate all direct and indirect costs incurred by AICIS and DCCEEW to each activity and subsequently each charge point.

The cost base comprises:

- Direct costs such as labour costs and some supplier costs that can be directly linked to a specific activity.

- Indirect costs, including corporate costs such as finance, human resources and property, which will be driven to activities using relevant activity drivers that will reflect the link between the cost of the services and the likely amount of those services absorbed to the amount allocated.

- Capital costs including depreciation and capital investment where appropriate.

Figure 1 (below) presents a schematic of the activity based cost model. An example of how a fee for service item is calculated is included at Attachment A.

Figure 1 – Activity Based Cost Model

Table 3 shows the estimated total cost of regulatory activities inclusive of support function costs using the ABC methodology.

Table 3 - Estimated cost by regulatory output for 2023-24 ($’000)

| Regulatory activities | Fee or Levy | Cost ($’000) |

|---|---|---|

| Registration applications | Fees for service | 561 |

| Certificate applications | Fees for service | 737 |

| Commercial evaluation authorisation (CEA) applications | Fees for service | 29 |

| Inventory Listing applications | Fees for service | 9 |

| Confidential business information (CBI) protection applications | Fees for service | 630 |

| Import / export of industrial chemicals into or out of Australia applications | Fees for service | 0 |

| Compliance monitoring and enforcement | Levy | 5,163 |

| Post-market evaluation of chemicals | Levy | 12,213 |

| Pre-introduction reports | Levy | 213 |

| Specific Information Requirements | Levy | 530 |

| Post-introduction declarations | Levy | 308 |

| Maintenance of Inventory | Levy | 1,161 |

| Stakeholder engagement/education | Levy | 261 |

| Enquiries and complaints management | Levy | 320 |

| Total6 | 21,568 | |

Figures include direct and indirect costs. Figures may not total due to rounding.

Aligning regulatory effort to fees for services

AICIS’s approach to activity based costing seeks to confirm the level of effort spent against a regulatory activity is proportionate to the risk. Fees for services have been maintained at 2022-23 rates while further effort data is collected to determine the true efficient cost of providing each service.

Aligning regulatory effort to the regulatory charge (levy)

The Charging Framework state that the levy payable should bear a reasonable relationship to the driver of regulatory activities in a manner that approximates the level of resources required to provide the activity across the regulated group.

As demonstrated in Table 3 above, the evaluations program and compliance program are the two biggest regulatory outputs intended to be recovered through the cost recovery levy. The information provided below demonstrates the link between risk and regulatory effort for these key regulatory outputs. This reflects the post-market nature of the scheme’s design.

Post-market evaluation of chemicals

AICIS evaluates risks from industrial chemicals already authorised for introduction and use in Australia, predominantly chemicals already listed on the Inventory. AICIS can also evaluate chemicals that are introduced under an assessed certificate or the reported or exempted categories, in response to emerging concerns and/or new information. In consultation with stakeholders, AICIS has committed to identify and prioritise industrial chemicals currently in use for evaluation that do not have a current risk assessment using the Evaluations Prioritisation Tool (EPT) and Evaluation Selection Analysis (ESA) criteria and process.

Limited available data suggests that as annual introduction value increases, businesses generally introduce:

- larger numbers of different chemicals, and in larger volumes, which increase exposure and the likelihood of greater risks to humans and the environment, and

- more complex chemicals, which require greater regulatory effort to characterise risk and correspondingly more complex risk management considerations.

Compliance monitoring and enforcement

AICIS uses a risk-based approach to promote awareness of obligations, check record-keeping requirements and identify and manage cases of non-compliance. By modifying monitoring activities to accommodate emerging risks, AICIS focuses on introducers at higher risk of non-compliance and introductions that pose a higher risk to human health and the environment. It is not possible to ascertain every introducer’s degree of compliance in advance of undertaking compliance monitoring or to base the funding model on the degree of risk of the chemicals introduced.

In monitoring compliance, when there are no other risk indicators – for example, among a group of industrial chemical introducers with no prior compliance history – regulatory effort is prioritised using introduction value as a proxy for exposure (and therefore risk). This is because, in a group of introducers introducing similar products, those introducing a greater introduction value will be importing/manufacturing a greater volume, which will result in greater risk and therefore, proportionately, greater regulatory effort.

Use of Introduction Value as a proxy for regulatory effort

To develop a charging regime that aligns with the Charging Framework, the most appropriate method for funding regulatory activities through the registration levy must be determined. The central principle of the Charging Framework is that charging be aligned with the drivers of regulatory effort.

The risk posed by a chemical is a function of hazard and exposure; exposure is a function of use pattern and volume. As the hazard of a chemical cannot be changed, risk management involves minimising exposure, where required. The risk-based approach for funding regulatory activities that are not services provided to identifiable recipients is also primarily based on levels of exposure of humans and the environment.

It is a long established international practice for the annual volume of introduced chemicals to function as a proxy for exposure, as a larger volume generally translates into more workers exposed, or more consumer products on the shelves (public exposure), or more of the chemical flowing down drains and into waterways (environmental exposure).

However, AICIS does not hold nor have legal authority to obtain data on the volumes of all industrial chemicals introduced into Australia. Furthermore, obtaining such data would involve substantial additional regulatory burden on industry, which is contrary to the policy aims of the recent reforms.

The value of introductions is readily available to Government, at the least burden to industry. As established above, introduction value is closely correlated with introduction volume and an increase in the number and complexity of chemicals introduced, which is indicative of risk that requires proportionate regulatory effort. It is on this basis that introduction value has been the legislative basis on which the levy was established under the former NICNAS for over 25 years and continues to apply under AICIS.

At this stage, there are insufficient data to definitively determine whether introduction value is the most appropriate proxy for regulatory effort. Through the effort data capture process undertaken by AICIS and DCEEWW, the data set will be more robust and analysis of a more robust data set will determine whether alternative charging approaches are more suitable to better align costs with charges. Any proposed changes will be included in the 2024-25 CRIS. Stakeholder consultation will occur before any proposed charging approaches are implemented.

Continuation of lower and upper threshold for calculation of charge payable

The introduction value thresholds for charging the registration levy are aligned with the risk-based approach to determining regulatory effort outlined above. Lower value introducers generally introduce lower volumes of chemicals resulting in lower human and environmental exposures than higher value introducers. However, at the higher value of introductions, the regulatory effort required does reach a plateau at a point, so it would not be risk-proportionate to charge a higher registration levy once the plateau has been reached.

Ongoing commitment to appropriate charging arrangements

AICIS will continue to monitor the maturation of the scheme to a steady state given it is a relatively new scheme. This will help AICIS to refine effort drivers for both levy funded and fee for service activities and thus ensure that fees and charges reflect the efficient cost of delivering regulatory activities and services. AICIS will also consider how to appropriately address the accumulation of prior year revenue held in the Industrial Chemicals Special Account. These issues will be further considered in consultation with Industry.

A moderate increase in fee for service application volumes is predicted for 2023-24, however a steady state for these applications has not yet become apparent under AICIS. In addition, higher than estimated effort to process certain application categories has been observed over the first three years of the scheme, due to some applications containing more supporting data than expected. Efforts to streamline assessment processes are underway.

Given the uncertainty outlined above, the need to gather more effort data, and to avoid undue price volatility for industry, fees for services in 2023-24 are proposed to be maintained at their 2022-23 rates. Further effort data will be collected in 2023-24 and fees recalibrated where appropriate in 2024-25.

Conversely, levy prices will be further reduced across all registration levels by approximately 11.7%. This reduction responds to consecutive operating budget surpluses resulting from higher than anticipated number of registrants at the higher registration levels, and the substantial increase in the interest equivalency payment on the special account expected for 2023-24 from $34k to $758k. This aligns with the balance management in strategy (refer to Section 4) of aligning revenue and expense to result in a break-even forecast for 2023-24.

3 Depreciation expenses are based on the existing asset profile, subject to change if assets are acquired or fully depreciated.

4 An operating reserve is maintained in accordance with the Balance Management Strategy at Section 4.

5 The total estimated cost base includes the cost of activities considered non-recoverable under the Charging Framework. These costs will not be recovered through the proposed fees and charges as indicated in Table 3.

6 Total estimated cost by regulatory output for 2023-24 excludes the FOI/non-cost recoverable amount of approximately $60k

4. Financial estimates

Financial estimates and underlying assumptions for the 2023-24 budget and forward years are set out in Table 4 (below), prepared on an accrual basis7.

Table 4 - Financial estimates for budget year and forward estimates ($’000)

| 2023-24 budget | 2024-25 forward estimate | 2025-26 forward estimate | 2026-27 forward estimate | |

|---|---|---|---|---|

| Operational Expenses (A) | 21,628 | 22,179 | 22,696 | 23,227 |

| Cost Recovered Revenue – includes fees for services and levies (B)8 | 20,880 | 20,880 | 20,880 | 20,880 |

| Government appropriation - interest equivalency payment (C) | 753 | 753 | 753 | 753 |

| Balance = (B+C)-(A) | 5 | -546 | -1,062 | -1,594 |

| Cumulative balance | 27,131 | 26,585 | 25,523 | 23,929 |

Material variance commentary: The financial estimates are based on predicted levels of fee for service applications and the number of expected registrants at each level. The estimates also include a substantial increase to appropriation funding in the form of an interest equivalency payment from interest earned on funds held in the Industrial Chemicals Special Account. Revenue forecast for 2023-24 are subject to fluctuations in:

- numbers of fees for services applications

- number of companies per level listed on the Register of Industrial Chemical Introducers

The annual rolling CRIS and future pricing reviews will ensure transparency and ongoing accuracy of revenue and expenditure and detect any upward or downward variations.

Balance Management Strategy: A reserve is used as a risk mitigation measure to allow established charging arrangements to balance and lessen the impact of variable demand on the ongoing delivery of regulatory activities. The AICIS Reserve is fully committed to the following three components, which are maintained to facilitate business continuity requirements, to help fund the ongoing resourcing requirements of AICIS and to allow the scheme to operate in a sustainable manner:

- Capital investment (51%): Includes costs recovered in regulatory charges where funding for replacement or enhancement to a capital asset has been provided by government. This revenue will be maintained in reserves earmarked to support future replacement or enhancements to capital assets;

- Three months operating reserves (27%); and

- Employee entitlements (22%): consistent with best practice, the reserve retains employee entitlements such as leave provisions’.

Note: Higher than anticipated number of registrants at the higher registration levels has resulted in an accumulation of prior year revenue. The further reduction in levy charges in 2023-24 is anticipated to prevent further accumulation.

7 Figures reported in the Portfolio Budget Statements may differ as they are reported on a cash basis in accordance with the Public Governance, Performance and Accountability (Financial Reporting) Rule 2015.

8 Projected revenue does not reflect any adjustment made to recover CPI and wage growth currently included within the projected cost base. AICIS will continue to consult with industry on how the indexed costs should be recovered across the forward years as part of future annual CRIS updates in accordance with the Charging Framework.

5. Financial performance

The financial results9 for the 2020-21, 2021-22 and 2022-23 years are shown below:

Table 5 - Financial performance

| 2020-21 | 2021-22 | 2022-23 | |

|---|---|---|---|

| Operational Expenses (A) | 19,369 | 19,197 | 21,650 |

| Cost Recovered Revenue – includes fees for services and levies (B)10 | 23,233 | 24,394 | 24,323 |

| Government appropriation - interest equivalency payment (C) | 965 | 58 | 34 |

| Balance = (B+C)-(A) | 4,828 | 5,255 | 2,707 |

AICIS’ activities are cost recovered from industry except for a modest amount of appropriation funding in the form of an interest equivalency payment from interest earned on funds held in the Industrial Chemicals Special Account. The surplus in 2022-23 was above the original estimate for the year. The 10% increase in total cost-recovered revenue over budget stems from higher than forecasted top tier introducers, (over>$5 m introduction value), and contribution from prior year registration level upgrades. Upgrades occur when registrants are identified through compliance monitoring, or self-report as having under-declared their introduction value and are subject to pay a higher registration charge.

Targets for operational expenses were not achieved for the full year and represented a variance of 4%. This underspend is primarily due to: contractors who were engaged later in the year than projected, consulting, project and legal costs, travel and training costs and costs related to lower than anticipated level of fees for services activity.

A review of financial performance is undertaken annually, and detailed performance information is discussed with industry representative bodies. AICIS uses this information to determine its balance management strategy and aims to maintain reserves in accordance with this strategy.

Depreciation equivalence is accumulated in cash reserves for the replacement of assets. The Government expects AICIS to manage within its cost recovery resources and therefore investment in new, or replacement of existing IT assets must come from the responsible management of cash reserves.

9 The historical financial performance of NICNAS prior to the commencement of AICIS in 2020 is not presented in the above table, due to the significant changes in regulatory activity under AICIS.

10 Projected revenue does not reflect any adjustment made to recover CPI and wage growth currently included within the projected cost base. AICIS will continue to consult with industry on how the indexed costs should be recovered across the forward years as part of future annual CRIS updates in accordance with the Charging Framework.

6. Non-financial performance

AICIS reports its non-financial performance for 2022-23 against criteria included in the 2022-23 Health Portfolio Budget Statements11 in the Department of Health Annual Report12, including a performance report from the Executive Director as required under section 146 of the Industrial Chemicals Act 2019.

11 Budget 2022-23: Health Portfolio Budget Statements, page 64, https://www.health.gov.au/sites/default/files/documents/2022/03/budget-2022-23-portfolio-budget-statements.pdf

12 Department of Health and Aged Care Annual Report 2022-23, pg 276, https://www.health.gov.au/sites/default/files/2023-10/department-of-health-and-aged-care-annual-report-2022-23_0.pdf

7. Stakeholder engagement and risk assessment

Stakeholder engagement

In accordance with the Charging Framework, stakeholder feedback will be sought on this draft 2023-24 CRIS, which provides information on:

- Government cost recovery policy

- how AICIS regulatory charging has been developed

- proposed AICIS fees and charges to be applied from 1 Sept 2023

- the ongoing review of AICIS charging arrangements.

Charging risk assessment

In accordance with the Charging Framework, a Charging Risk Assessment (CRA) has been undertaken that considered the future operating environment, including its:

- complexity: structure, processes and implementation of cost recovery activities;

- materiality: financial value of the cost recovery activities; and

- sensitivity: level of interest from key stakeholders in the cost recovery activities.

The overall cost recovery risk rating for 2023-24 is determined to be medium.

These identified key risks and their mitigation strategies are documented in Table 6 below.

Table 6 – Risks and risk mitigation strategies

| Risk | Mitigation Strategy |

|---|---|

| Assumptions made for the new scheme are not reflective of actual regulatory effort or costs | Regulatory effort and costs will continue to be monitored. Assumptions informing the cost model will continue to be replaced by contemporary data as collected. AICIS continues to gather internal effort data. It is expected that the results will be documented in 2024-25 CRIS. |

| Under- or over-recovery through levies due to change in introduction value of industrial chemicals per introducer. | Introduction value monitoring will continue, and levy charges reviewed through the annual CRIS process. |

| Under or over-recovery of fee for service activities due to the low number of applications made under the IC Act 2019. This is especially relevant given the post introduction regulatory focus of the scheme. | Volumes of applications and associate effort will be monitored, and charges will be reviewed through the annual CRIS process. Prices will not be revised in the 2023-24 CRIS due to insufficient data being available to substantiate significant year on year volume variation. |

| AICIS cost base exceeds budgeted position depleting the reserve balance beyond targeted levels. | The impact of any reduced charging on the reserve balance will be monitored to ensure financial sustainability. |

8. Fees and annual charges – 2023-24

The schedule of fees and charges was developed to align with the Charging Framework and recover the costs of AICIS activities for 2023-24. The fees and charges apply to introducers of industrial chemicals.

The charge points for AICIS can broadly be grouped by relevant activities:

- Registration – levy12 and fee for service

- Certificates and Commercial Evaluation Authorisations – fee for service

- Protection of confidential business information (CBI) – fee for service

- Import and export of certain industrial chemicals subject to international agreements – fee for service

Further detail on the design of regulatory charges is provided in Section 3.

Annual registration fee

The Industrial Chemicals Act 2019 imposes an annual registration fee and levy (where relevant) on all introducers of industrial chemicals. As discussed in Section 3, the registration fee recovers the costs of registering individuals and maintaining the Register of Industrial Chemical Introducers, which are activities provided to the individual or organisation.

Table 7 – Registration fee 2023-24

| AICIS Fee for service | Fee per application ($) 2023-24 |

|---|---|

| Application for registration | 75 |

Annual registration charge (levy)

The registration levy recovers the costs of activities provided to a broader group of individuals and organisations. The registration level and charge payable is determined for each registrant based on the annual introduction value using prior financial year introductions (as defined in Section 6 of the Industrial Chemicals Charges (General) Regulations 2020, Industrial Chemicals Charges (Customs) Regulations 2020 and Industrial Chemicals Charges (Excise) Regulations 2020). Further information on the use of introduction value to calculate the levy payable is available in Section 3.

An eight-tiered model is used to determine the annual registration charge payable and the levy charging structure will remain unchanged from 2022-23. Similarly to 2022-23, an exemption from paying the levy for introduction values less than $50,000 in the previous financial year. The cap on payable registration charge is reduced by $36,700 to $32,405 on the maximum levy payable by an Level 8 introducer apply. This is based on increasing numbers paying at the highest level.

Levy prices have been reduced across all registration levels by approximately 11.7%. The resulting charges are presented in Table 8 below.

Table 8 - AICIS Registration levy 2023-24

| Registration level (prior year introduction value) | Charge per registration ($) 2023-24 |

|---|---|

| Registration – level 1 ($1 - $49,999) | NIL |

| Registration – level 2 ($50,000 - $74,999) | 65 |

| Registration – level 3 ($75,000 - $99,999) | 80 |

| Registration – level 4 ($100,000 - $249,999) | 205 |

| Registration – level 5 ($250,000 - $499,999) | 400 |

| Registration – level 6 ($500,000 - $2,999,999) | 2,430 |

| Registration – level 7 ($3,000,000 - $4,999,999) | 4,065 |

| Registration – level 8 ($5,000,000+) | 32,405 |

Certificates and Commercial Evaluation Authorisation fees

Table 9 – Certificate and authorisation fees 2023-24

| AICIS Fees for services | Charge per application ($) 2023-24 |

|---|---|

| Certificate Applications | |

| Application for a certificate – very low to low risk | 7,435 |

| Application for a certificate – health focus or environment focus | 23,375 |

| Application for a certificate – health and environment focus | 34,965 |

| Application for a certificate - comparable hazard assessment | 17,515 |

| Consolidated application | 7,015 |

| Application to vary the terms of an existing Assessment Certificate | 4,735 |

| Application to add a certificate holder | 1,490 |

| Application to remove a certificate holder | 805 |

| Application to add a person covered by a certificate | 1,490 |

| Application to remove a person covered by a certificate | 805 |

| Multicomponent Application | 2,650 |

| Authorisation Applications | |

| Application for a Commercial Evaluation Authorisation | 6,490 |

| Application to vary the terms of an authorisation | 2,525 |

| Application to add an authorisation holder | 1,490 |

| Application to remove an authorisation holder | 805 |

| Listing Applications | |

| Application for listing on the Inventory before 5 years | 1,490 |

| Application for variation of listing | 4,735 |

Protection of confidential business information (CBI)

Table 10 - Protection of confidential business information (CBI) 2023-24

| AICIS Fees for services | Charge per application ($) 2023-24 |

|---|---|

| Application for protection of proper name | 1,730 |

| Application for protection of end use | 605 |

| Application for continued protection | 4,565 |

| Application for protection of confidential business information (CBI) other | 1,150 |

| Application to be a confidence holder of CBI for a protected inventory listing | 4,100 |

Import and export of certain industrial chemicals subject to international agreements

Table 11 - Import and export of certain industrial chemicals subject to international agreements 2023-24

| AICIS Fees for services | Charge per application ($) 2023-24 |

|---|---|

| Application for Category A export of industrial chemicals out of Australia | 2,395 |

| Application for Category B export or import of industrial chemicals into or out of Australia | 4,780 |

12 Levies predominantly fund AICIS compliance and evaluations programs

9. Key dates and events

The key forward dates and events are documented in Table 12.

Table 12 – Key forward dates and events

| Key forward events schedule | Next scheduled update |

|---|---|

| Update CRIS for 2024-25 | July 2024 |

The history of changes made to the CRIS and approvals are documented in Table 13.

Table 13 - CRIS approval and change register

| Date of change | CRIS change | Approver | Basis for change |

|---|---|---|---|

| 26/06/2020 | Certification of the CRIS | Acting Secretary, Department of Health | New cost recovered activity |

| 29/06/2020 | Approval of the CRIS | Responsible Minister | New cost recovered activity |

| 30/06/2020 | Agreement to CRIS release | Minister for Finance | High-risk rating for the activity |

| 9/06/2021 | Certification of the CRIS | Secretary, Department of Health and Aged Care | New cost recovered activity |

| 23/06/2021 | Approval of the CRIS | Minister for Regional Health, Regional Communications and Local Government | New cost recovered activity |

| 30/06/2021 | Agreement to CRIS release | Minister for Finance | High-risk rating for the activity |

| 1/12/2021 | Update on 2020-21 financial performance | AICIS Executive Director | Reporting on financial performance |

| 1/08/2022 | Certification of the CRIS | Secretary, Department of Health and Aged Care | Reduced registration charge amounts |

| 2/08/2022 | Approval of the CRIS | Assistant Minister for Health and Aged Care | Reduced registration charge amounts |

| 30/11/2022 | Update on 2021-22 financial performance | AICIS Executive Director | Reporting on financial performance |

| 24/07/2023 | Certification of the CRIS | Secretary, Department of Health and Aged Care | Reduced registration charge amounts |

| 1/08/2023 | Approval of the CRIS | Assistant Minister for Health and Aged Care | Reduced registration charge amounts |

| 30/11/2023 | Updated on 2022-23 financial performance | AICIS Executive Director | Reporting on financial performance |

Attachment A – Example fee calculation

The charge for any specific regulatory output should recover the full efficient cost of delivering that specific service. This section outlines the methodology used to cost one such regulatory output: “Registration of industrial chemical introducers”, broken down into business processes and activities.

Table 14 - Cost calculation: processing an ‘Application for registration’

| Regulatory output | Business process | Effort required (hrs) | Average cost per hour ($) | Cost per delivery of regulatory output ($) | Volume delivered annually | Total cost of regulatory output ($) |

|---|---|---|---|---|---|---|

| Registration of industrial chemical introducers | Maintaining register of industrial chemical introducers | 0.56 | $137.01 | $76.57 | 7,326 | $560,958 |

Table 15 breaks down the component tasks of the business process, showing the role that performs each task, the effort required to complete each task, and the cost of each task.

Table 15 - Cost calculation breakdown of the business processes for ‘Maintaining register of industrial chemical introducers’

| Business process | Activities involved | Role performing task | Hours of effort | Cost per role ($) |

|---|---|---|---|---|

| Maintaining register of industrial chemical introducers |

| Registration Support Officer | 0.36 | $48.82 |

| Registration Officer | 0.10 | $13.19 | |

| Assistant Director of Corporate | 0.10 | $13.22 | |

| Director of Corporate | 0.01 | $1.33 | |

| Total hours of effort per application | 0.56 | $76.57 | ||

Table 16 breaks down the component tasks performed by the Registration Support Officer showing the hours of effort required to complete the tasks, the cost per hour of the role, which produces the cost of the task.

Table 16 - Cost calculation breakdown of ‘Registration Support Officer’

| Activities | Role performing task | Role cost per hour ($) | Hours of effort per task | Cost per task ($) [Role cost per hour] x [Hours of effort per task] |

|---|---|---|---|---|

Responding to enquiries from registrants Manual processing of hard copy registration forms submitted by some registrants Payment processing Assessment and processing of write-offs/refund Maintaining integrity of register | Registration Support Officer | $137.01 | 0.36 | $48.82 |

Table 17 breaks down the cost per hour of the role Registration Support Officer.

Table 17 - Cost calculation breakdown of Registration Support Officer by direct and indirect cost

| Role | Direct cost per hour ($) | Indirect cost per hour ($) | Total cost per hour ($) |

|---|---|---|---|

| Registration Support Officer | $68.33 | $68.68 | $137.01 |

Attachment B - Summary of main stakeholder views and AICIS responses

A total of 8 submissions were received. The main stakeholder views are summarised below alongside corresponding responses.

| Stakeholder Comment | Response |

|---|---|

| Proposed fees and charges for 2023-24 | |

| Reducing registration charges by approx.11.7% and maintaining fees for service at 2023-24 rates is welcomed. | Stakeholder views are noted. |

| Ongoing commitment to appropriate charging arrangements | |

| Continued benchmarking of cost for AICIS services is welcomed and supported. | Stakeholder views are noted. |

Registration levy costs

| Stakeholder views are noted. As noted in the CRIS, the review which informed charging arrangements acknowledged the inadequacy of representative data gathered over specific short periods of operation of the scheme. It identified the need for further evidence to inform a meaningful analysis of the cost drivers of levy funded activities in the context of the thresholds of the 8-tier registration charging model (section 3). The CRIS commits to continue collection of further regulatory effort data to inform further analysis of the appropriateness of the 8-tier registration charging model. In delivering AICIS’s ongoing commitment to appropriate charging arrangements in accordance with the Australian Government Charging Framework, AICIS will continue to consider the following factors in setting fees and charges:

|

Aligning regulatory effort with registration charge

| Stakeholder views are noted. AICIS is designed to align regulatory effort with the risks posed by industrial chemical introductions to promote innovation and encourage the introduction of lower-risk chemicals.

In keeping with the Charging Framework principles for the efficient implementation of cost recovery arrangements, information required to determine introduction value is readily available to introducers and does not impose an additional burden. It is for this reason that introduction value is currently considered to be the most appropriate proxy for regulatory effort expended on levy funded activities. The AICIS will continue to gather contemporary data to undertake a more fundamental examination of the charging model through the 2024-25 CRIS. Stakeholder consultation will occur before any proposed charging approaches are implemented. |

Impact on Australian industry and innovation

| The AICIS Scheme is designed to promote innovation toward safer chemistry by restricting pre-market risk assessments to higher risk chemical introductions. For businesses introducing lower risk chemicals, regulatory intervention shifts from pre- to post-market. There is also greater opportunity to use overseas information under AICIS, including a streamlined introduction pathway where chemicals with certain international risk assessments can be introduced without a pre-market assessment, significantly reducing time to market. |

| Unclear direct benefit to industry of evaluations of chemicals already on the Inventory, although there is arguably a broad public benefit. | The Charging Framework states that “due to the difficulty in identifying pure public goods, this is not considered to be a criterion in determining whether cost recovery is appropriate. A range of other relevant considerations inform the final decision by the Australian Government about cost recovery for a specific activity.” |

| The process for smaller introductions (like soap makers) is overwhelming and confusing. | Stakeholder views are noted, however the issue raised is not within the scope of the CRIS. |

13 Principles for cost recovery of the Australian Industrial Chemicals Introduction Scheme: https://web.archive.org.au/awa/20200629141424mp_/https://www.nicnas.gov.au/__data/assets/word_doc/0010/89623/AICIS-cost-recovery-principles-paper-Final-16-Sep-2019.docx